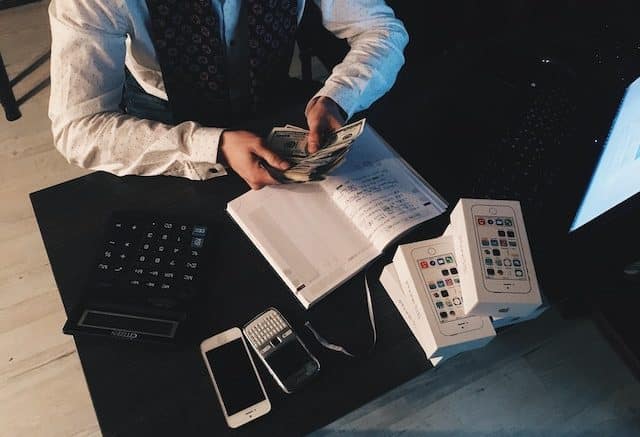

Almost one million small companies are running their businesses with £1,000 or less in the bank put aside to help them survive any decline in their revenue.

This is the suggestion from a study which involved canvassing the opinions of 500 bosses following what researchers saw as a tumultuous three-year period marred by the COVID-19 pandemic and the ongoing cost of living crisis.

Nearly half of them said they can save significantly less now than they could three years ago so it’s no surprise that savings levels are so low. Based on the 5.5 million classed as SMEs who are currently trading within the UK, the 17 per cent that admit to having £1,000 or less saved, amounts to £935,214.

As experts suggest that businesses should have three-six months of operating costs saved in the bank, Yell.com says this paints a particularly worrying picture, especially as the research also found that one in 10 with up to 49 employees have no savings whatsoever, putting the jobs of millions at risk.

The ongoing cost of living crisis is undoubtedly having an impact on businesses having the ability to save, as one in 10 say they can’t save anything each month, with a further 9 per cent also only able to save up to £200 per month. For sole traders, this is even more of a concern, as one in three currently don’t save anything to help keep their business buoyant each month.

A common reaction can be to cease marketing activity, but time and again we see this as a counterproductive option

Inflated costs and low savings are certain to have a knock-on-effect on the confidence of those at the top, and Yell’s study goes on to show that 2023 could be a troubling year for many. One in 10 – amounting to 550,126 UK businesses – aren’t confident they’ll be afloat in six months’ time, a number that rises again when looking further towards 2024.

This lack of confidence is more prevalent in certain parts of the country than others, with more business leaders in London feeling the pinch of what is an already expensive location to run a business and worrying whether they will still be around come 2024.

Yell CEO Mark Clisby, said: ‘’There is currently a lot of discussion around personal savings, and this feedback from UK SMEs is a good reminder of the importance of regularly reviewing where to invest and where to make savings.

“Quite often, a common reaction can be to cease marketing activity, but time and again we see this as a counterproductive option. Marketing is required to bring in new customers and keep revenue coming in and your competitors may be increasing their media investment, so will be more prominent.”

Related

Workers savings would last one month

Businesses weeks from running out of cash