Despite being a major economic player and main trading partner of more than 120 countries, China is struggling to impose its currency, the yuan, as a means of international exchange capable of replacing the two historical behemoths that are the US dollar and euro.

Together, the US dollar and euro represent three-quarters of international payments according to the SWIFT payment platform, compared to only 2.3% for the RMB. After initiatives for the internationalisation of the Chinese currency in recent years saw only small gains, the war in Ukraine and the return of a world fragmented into two political blocs headed by China and the United States could accelerate greater use of the Chinese currency.

China’s economy grows while yuan usage lags

The yuan’s less frequent usage does not reflect China’s commercial power. That said, the currency is gaining more ground to the point that it is currently the 5th most traded currency in foreign exchange markets behind the dollar, the euro, the Japanese yen, and the pound sterling.

According to a recent survey from the Bank for International Settlements, the yuan is also the 5th most represented currency in international payments and in central bank reserves.

Yet the process of internationalisation of the yuan is very recent and only dates back to 2009 with the establishment by Chinese authorities of a system allowing foreign companies working in mainland China to negotiate in yuan.

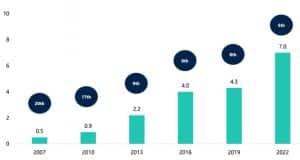

Chinese yuan adoption increased by 140 per cent over 15 years (Percentage share of RMB in daily FX transactions, and global ranking)

Since then, there has been a real rise in power of the yuan internationally, which has seen its share in foreign exchange transactions multiply by 14 times between 2007 and 2022 (from 0.5% to 7.0%), moving from 20th to 5th place in the rankings of the most traded currencies in the world. Despite this phenomenal expansion, the yuan is still very much underused; per BIS, it accounted for 7% of foreign exchange transactions in 2022 while China’s overall weight in world trade was 12% in 2022, according to IMF data.

The yuan is trying to break out of the shadow of the greenback

Despite its rapid expansion — from an admittedly low base — the yuan is currently still seen as a “minnow” in the foreign exchange world, especially when compared to the US dollar which is, by far, the most traded currency in the world and the main reserve currency. The yuan still lives in the shadow of the USD partly because for more than 10 years (1994-2005) the Chinese currency was linked by a fixed exchange rate regime based on the US dollar at of a rate of 1$ = ¥8.28.

Despite breaking this link in 2005, the shadow of the dollar is still present in Chinese trade and the majority of cross-border trade is done in dollars. However, the situation is changing and for the first time this year, foreign payments in yuan in mainland China are now higher than those in dollars.

In terms of receipts, the reversal has not yet occurred, however, the Chinese currency is now almost on par with the greenback, proof the yuan has become a credible alternative to the dollar – at least internally in China. To make inroads globally, the yuan must at least occupy a dominant position in foreign payments to and from its domestic market.

Above all, this denotes a desire on the part of the Chinese political authorities to promote the yuan in order to gradually extract themselves from the influence of the dollar, which is becoming untenable in view of geopolitical tensions between China and the United States and the deterioration of diplomatic relations in recent years.

However, China is not the only country that wants to distance itself from the dollar. This global phenomenon is referred to as “de-dollarisation”.

De-dollarisation to benefit the yuan?

While the internationalisation of the yuan is not new, there has been a clear acceleration of the phenomenon since the beginning of the conflict between Russia and Ukraine. The substantial international sanctions imposed on Moscow by the Western bloc led by the United States disturbed some unaligned countries.

By freezing the Russian central bank’s foreign exchange reserves and removing Russian banks from the SWIFT international payment network, Washington and its allies have attempted to weaken Russia by preventing it from making transactions in dollars, including payments to both creditors and suppliers.

These unprecedented sanctions have highlighted the risks raised by the monopolistic position of the dollar and the way it has been weaponized in this conflict. This strategic choice marks a significant turning point because it stressed to many countries their dependence on the US currency and the resultant economic and financial risks.

This was especially true in 2022 when the prices of raw materials and commodities such as oil and the dollar soared together.

The Ukrainian conflict has seen the reappearance of a “Cold War,” and a world cut in two

Due to sanctions, Russia made the political choice to turn to China to compensate for the loss of European markets in the sale of oil and gas, and to the yuan as an alternative to the dollar and the euro for transactions. In the space of a year, the yuan has become Russia’s most traded foreign currency, and thus constitutes a first success story for the yuan in its quest for credibility against historically dominant currencies.

With the Russian experience as an example, several countries have since turned to China and the yuan with the primary aim of reducing their exposure and their dependence on the American currency.

For example, in 2023 China announced several trade disintermediation agreements with some big emerging economies like Argentina, Brazil or Saudi Arabia, allowing customers from those countries to pay their suppliers directly in yuan.

The Ukrainian conflict has seen the reappearance of a “Cold War,” and a world cut in two with on one side a Western bloc led by the United States, and on the other a bloc opposing American interventionism and the centralisation of the dollar in the world economy led by China and Russia.

From this opposition, the yuan could be the big winner if this Eastern bloc looks to make the yuan their currency of exchange internationally. One of the keys to success will be for the yuan to impose itself as a key currency within the energy market– Moscow could help by selling its oil and gas in the Chinese currency.

Pakistan has just made its first purchase of Russian oil in yuan in June – a significant development.

The dominant position of the dollar in the world economy can’t be called into question in the short and medium term. The USD clearly remains the main currency for transactions and reserves.

However, its gradual loss of influence, as evidenced by the falling proportion of the American currency in world foreign exchange reserves (down to 58% at the end of 2022), could pave the way for greater use of the yuan.

That said, the Chinese currency still has a long way to go. To further its international appeal, the RMB will require further support from Chinese authorities including a reduction in capital control measures at the local level and greater transparency in policy decisions.

Without a major change in policy from the Chinese government, the Chinese yuan might find it hard to make further significant gains from here.

For more about the latest in cross-border payments, Sign up for Convera’s Currency Convo to get currency news, FX, and market insights from our team of regional experts.

And dive deeper into the trends shaping cross-border payments today with our podcast, Converge.