Jeremy Hunt has delivered his expected ‘Budget for growth’, announcing a multi-billion pound package to boost business investment bolster the country’s workforce, and a £4bn boost for free childcare.

Against a tough fiscal backdrop and his commitment to hold down spending to control inflation, came the pledge that business will be the main beneficiary of any tax cuts.

Sticking to the Government’s levelling-up philosophy he reiterated his underpinning principles of “Enterprise Employment, Education and Everywhere”, supporting the latter with a series of nationwide regeneration projects.

Also in the mix were tax breaks for drugs companies and TV firms, new corporation tax threshholds, help for the disabled to get back into work, changes to pensions and benefits, a boost support for artificial intelligence businesses as well as what he called a “quantum strategy” to support the future of computing.

Other key takeaways included: an extension of the EPG for another three months, sanctions reforms aimed at getting people on Universal Credit benefits into work, an extra £6 billion on maintaining the 5p fuel duty cut and a new apprenticeship scheme will target over-50s who want to return to work, so-called ‘returnerships.’

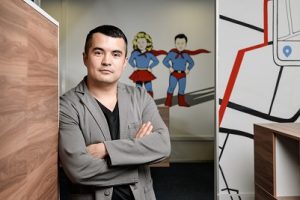

Giniatulin: parents will get a sense of normality

Vadikh Giniatulin, Chief Executive Officer and Co-Founder of Find My Kids welcomed the announcement on free childcare: saying that the “news comes at a time when parents are being forced to choose between childcare and their career as the financial burden of having one or more children in full-time care wasn’t possible”.

He added: “This new initiative will not only give parents a sense of normality but also peace of mind that their children are getting the care and opportunity to develop alongside their peer group.”

Steven Winter, Public Sector Regional Sales Manager at Cradlepoint, descrjbed it as “incredibly disappointing the government has overlooked improving next generation cellular connectivity”.

He said: “At a time when many businesses are facing economic uncertainty, ensuring infrastructure is there to support innovation and flexibility is vital. In fact, a recent Cradlepoint study found that 93 per cent of UK businesses stated that improving connectivity would make them more resilient to future economic and social shocks.

“The UK government needs to be more forward thinking in how it plans to tackle the connectivity challenges currently plaguing the country and affecting the economy. It is time meaningful steps to improve connectivity, instead of relying on legacy technologies, or we greatly risk lagging as an innovative country. ”

This Budget was a mixed bag. The PM makes a habit of mentioning that he’s spent time in Silicon Valley, while the Chancellor often references his own entrepreneurial experiences

Mark Benson, CTO at Logicalis UK&I felt the budget was “largely well-received by the tech sector”, adding that the financial support being put forward “shows that they are invested in the future of our industry”.

But he said he would have liked to see a workable the timetable for the plan to build confidence and get the UK tech market behind the initiative.

He sauid: “It is no secret that the UK is at real risk of being left behind in this space. We have already seen plants opening up in different geographies, such as India, the EU and US Chip Acts. It would be helpful to understand the UK government’s plan of action as well.”

Jamie Anderson, Chief Revenue Officer at Emburse welcomed the continuation of energy support schemes as “the least the government can do”, adding: “It is still not enough when it comes to safeguarding the 78 per cent of young people experiencing increased living costs, with many becoming increasingly isolated in attempts to make ends meet. With an excess of 8 million households affected by fuel poverty this year, the situation offers very little for those already living below the breadline.”

He added: “Public finances continue to be fragile, and businesses must keep their foot on the peddle when it comes to valuable employee care. Emburse’s latest survey found almost half of young workers want a company-paid card for their expenses due to that cost of living. Leadership must listen and put meaningful policies in place that make a difference to worker’s lives. “

Ritam Gandhi, founder and director of Studio Graphene, said: “This Budget was a mixed bag. The PM makes a habit of mentioning that he’s spent time in Silicon Valley, while the Chancellor often references his own entrepreneurial experiences. So, it stands to reason they’d champion entrepreneurship, particularly in tech, and these topics were certainly at the heart of Hunt’s speech – yet he also overlooked some key issues inhibiting innovation and growth.“Yes, there were positives: there were boosts for AI companies. Tax cuts for R&D and those investing in IT and machinery in the UK are to be welcomed. And the investment zones sound promising, but exactly how and where the £80 million of funding will be spent in those 12 hubs remains to be seen?

Although the UK economy has shown signs of rebounding, it is imperative that the government continues to prioritize the tech sector

“In the meantime, some of the most common challenges UK tech businesses face were not adequately addressed – namely, accessibility of funding for scaling businesses (kicked down the road to the Autumn Statement), and helping plug the tech skills shortage that holds back so many digital companies.”

Sam Martin, CEO of Peckwater Brands, said: “Hospitality is a lynchpin of trade and employment, and can be a major driver for economic growth and recovery. Yet the sector is also more significantly impacted by today’s challenges than most, as they are both energy intensive and subject to the inflated price of goods, notably food costs.

Douglas Reid: a further layer of complexity for companies that invest in innovation

“To allow hospitality to thrive, businesses required a major overhaul of the business rates system, a shot in the arm to staffing, and increased support with energy costs. The measures laid out for hospitality in the Spring Budget fall short of the level of support that industry leaders have been crying out for over the past year.“Hospitality can be a driver for the economy and a source of both jobs and tax revenue, but without the right conditions to grow, we will likely see businesses shut down by high business rates, unaffordable tax bills and short staffing.”

Corporate finance and M&A expert, Claire Trachet, described it as positive that the chancellor stuck to the decision of increasing corporation tax to 25 per cent, adding that she supports the government’s efforts to ensure that all businesses contribute their fair share. She said: “Measures such as the implementation of ‘full expensing’ are critical for growth in curbing the impacts of this. This will help to support businesses, particularly in the tech sector, where investment in equipment and infrastructure is critical to growth and innovation.

“Although the UK economy has shown signs of rebounding, it is imperative that the government continues to prioritize the tech sector. While the Science and Technology Framework is a positive step, sustained investment and attention are needed to maintain Britain’s status as a leading country for tech innovation and growth. “

Steve Malkin, CEO and founder of sustainability and net zero certifier Planet Mark, said: “It was encouraging to hear the Chancellor class nuclear as environmentally sustainable. This is a pragmatic step forward given the climate emergency we are facing. However, this must come alongside greater investment into renewables, on land and sea, if we are to secure economy-wide decarbonisation.

“There must also be greater long-term investment in supporting our nation’s SMEs to reduce their energy bills through reducing their emissions. This is especially important in lieu of any additional immediate government support on energy bills and as they make up around 90 per cent of all UK companies.

No one can doubt London’s contribution to the UK economy, but if we are to be the economic superpower the UK Chancellor so clearly desires, then other regions must be given the opportunity to thrive

“While tax relief on energy efficiency measures is welcome, an urgent nationwide awareness campaign for SMEs on how to cut emissions, alongside more ambitious energy efficiency incentives, will be necessary to make the UK a green growth superpower.”

Douglas Reid, Tax Director at ABGI welcomed the reduction in proposed cuts to tax relief for “what the Government has deemed ‘R&D intensive’ businesses, however the arbitrary cut-off point requiring companies to invest 40% of their total expenditure will penalise those who fall only marginally short of that figure.

“This will add a further layer of complexity for companies that do invest in innovation and may lead to the redesign of corporate structures with the goal of clearing the 40% threshold to maximise tax reliefs.”

Hubspot director Seona Tully said the budget was “a step in the right direction to removing location as a barrier to enterprise success”, there is still more that can be done.

The three-month continuation of the Energy Price Guarantee will be welcome news, but SMEs up and down the country will still have very real concerns as to what comes after that

“No one can doubt London’s contribution to the UK economy, but if we are to be the economic superpower the UK Chancellor so clearly desires, then other regions must be given the opportunity to thrive,” she added. “This change won’t happen overnight but it’s a start. As part of the twelve new investment zones, we’ll need to see continuous support to ensure that these areas aren’t left isolated but brought into the country’s global marketplace.”

And Alan Thomas, UK CEO at insurer Simply Business, felt that, while important measures have been put in place, such as an increase in the Annual Investment Allowance to £1m and improving childcare support, the fear remains that they will only scratch the surface.

“The cost of energy is front of mind for the majority of small businesses, with over half saying this is the single greatest threat to their business in 2023. The three-month continuation of the Energy Price Guarantee will be welcome news, but SMEs up and down the country will still have very real concerns as to what comes after that.”

mMark Smith: limited eligibility

Mark Smith, Partner R&D Incentives and Grants at Ayming UK, said it was clear the Government clearly recognises that its decision to cut tax relief for all SMEs in November undermines its ambition to make Britain the next Silicon Valley.

“In particular, the Government’s new funding for R&D-intensive businesses will allow the UK’s most innovative companies to do what they do best,” he said. “The structure the Chancellor ran through sounds sensible and clear, with 40 per cent of spend being a straightforward figure and goal for others to work to.

“However, it is a lot more targeted and therefore not as accessible. Forty per cent of spend on R&D is very high, so only a very small portion of UK businesses will be eligible. The government estimates about 8,000 businesses could benefit, which is about 10 per cent of current claimants. All other small businesses that don’t meet the threshold will still see a cliff edge in funding, which will most certainly have an impact on the UK’s innovation as a result.”