By Martin Hooper

Now is a good time for companies with end of March or early April year-ends to consider how their pension scheme liabilities will impact their balance sheet. Martin Hooper, Associate at Barnett Waddingham, says it may not all be bad news despite the increase in volatility in equity markets over the early part of 2018.

Now is a good time for companies with end of March or early April year-ends to consider how their pension scheme liabilities will impact their balance sheet. Martin Hooper, Associate at Barnett Waddingham, says it may not all be bad news despite the increase in volatility in equity markets over the early part of 2018.

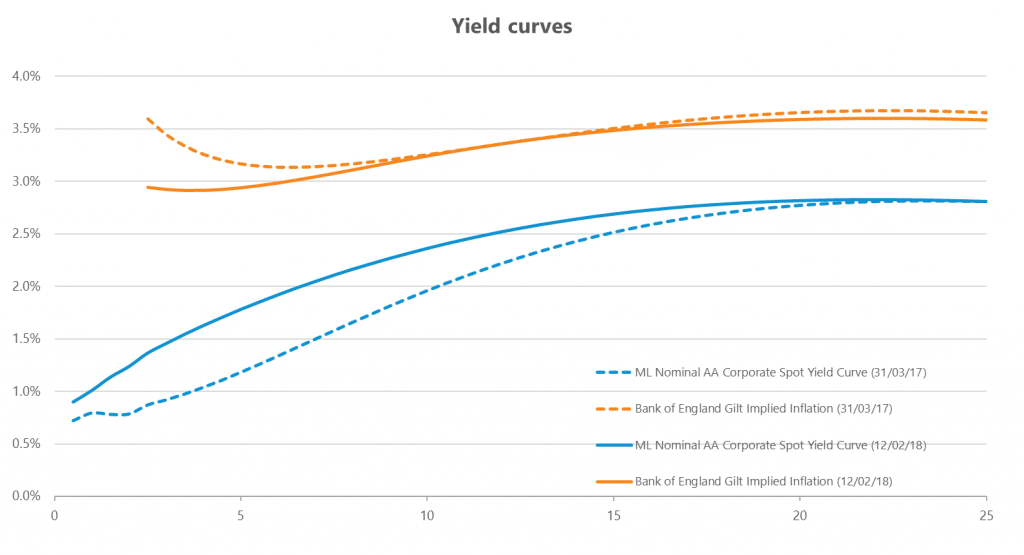

Inflation and yield pressures ease

Over the period since 31 March 2017, we have seen inflation expectations reduce slightly and corporate bond yields increase, especially at shorter terms, both of which should lead to a reduction in value of pension scheme liabilities under IAS19.

Source: Bank of America and Bank of England

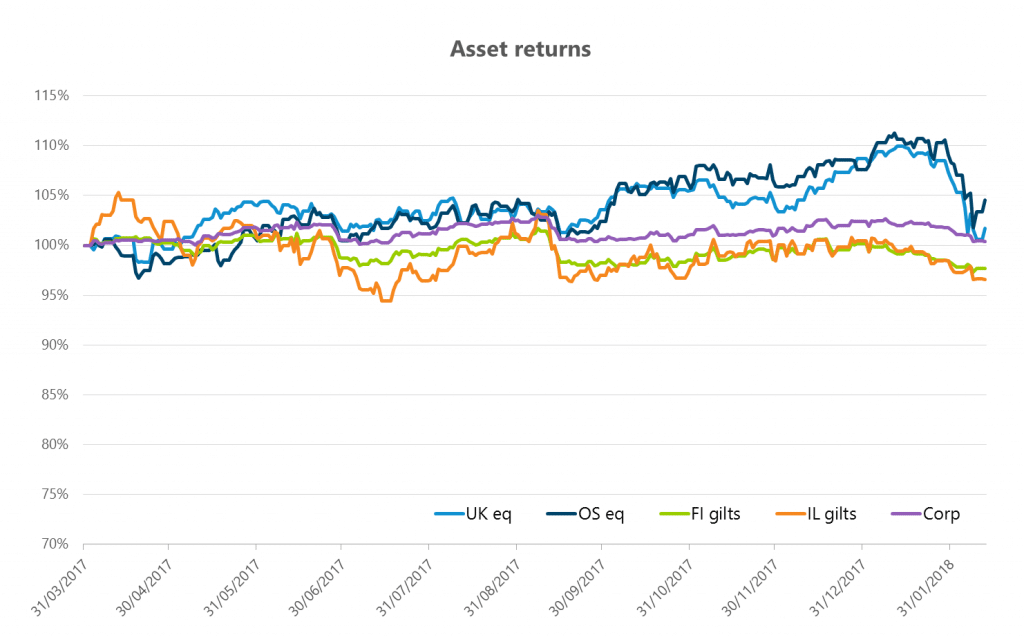

Assets returns mixed

Returns from equities have been mixed, but for a well-diversified portfolio of global equities returns should have exceeded expectations over the period. For pension schemes with a greater weighted to growth assets, e.g. equities, over protection assets, e.g. government bonds and swaps, the funding position is likely have improved since 31 March 2017 – even before any contributions to reduce the deficit are taken into account. For schemes with greater allocations to protection assets, the position is likely to have held broadly steady or possibly deteriorated slightly for those schemes with a high allocation to gilts or swaps.

Source: FT, iBoxx

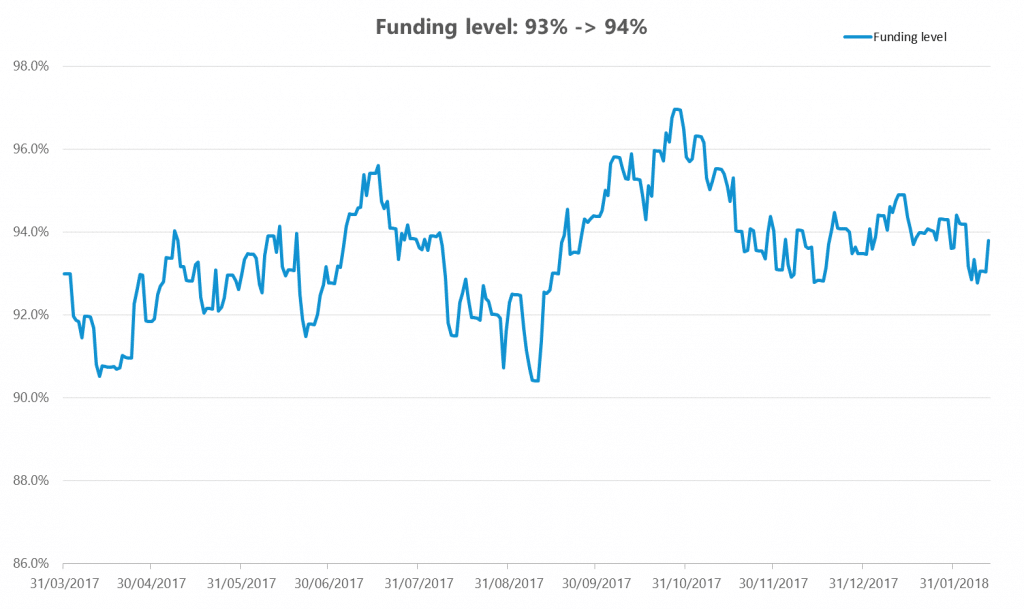

Deficits marginally reduced?

The chart below shows the development of the funding position for a typical pension since 31 March 2017 and if markets remain stable for the next couple of months this is the position we might expect at the end of March 2018:

Source: Barnett Waddingham model

Source: Barnett Waddingham model

Given the recent volatility in equity market valuations there is still potential for significant variations in the actual position. While downward pressure on bond yields has eased slightly in the early part of 2018 it is certainly possible for this to be reversed in the run up to the end of March 2018. A small change in either could cause a material change in the pension balance sheet figure.

What can be done?

The current level of corporate bond yields, which feed into low discount rates and high liability values, have caused many companies to use the method used to set this and other assumptions. This has often resulted in lower balance sheet deficits – for example, Tesco shaved approximately £3bn from its pension liability value last year by reviewing assumptions. For companies that not have already done so now would be a good time to consider whether any adjustments are possible for the coming year end.

Most of the past decade has seen an incredibly durable equity bull run. This has pushed up equity valuations across developed markets. The cyclically adjusted price-earnings ratio (CAPE) of the US stock market is at a level not seen since the dotcom bubble and the 1929 crash, at around 34. Historically, when the CAPE has exceeded 28 the returns achieved over the next decade have averaged approximately zero.

Whilst the Trustees have effective control of the investment strategy, the sponsoring employer retains all the risk. You should understand the risk being run and how you can influence the investment strategy to reduce that risk.

Reducing risk does not necessarily mean selling growth assets. In fact, most schemes need growth assets, and the associated returns, to ultimately pay all of the promised benefits. Reducing risk means increasing the certainty that the money currently set aside, plus committed contributions, is sufficient to pay benefits. Taking this approach should reduce, and eventually remove, the pensions burden from sponsors.

The time for thinking is now.

For more information on our FTSE350 report, please review here.

Be the first to comment on "Pension scheme liabilities: it’s not all bad news"