It’s time to prepare your business to change how you think about risk. Risk will increasingly be recast in a positive light – so just how ready is your business to embrace that change?

A new initiative by ACCA – the global accountancy body – has highlighted 10 key drivers that are set to force change upon business processes, people and services, and more specifically how the finance function within those businesses will need to prepare and adapt to meet these transformative challenges.

Challenges such as digital, new technologies, the global economy, politics, legislation, cyber security, ethics, even climate change are all set to impact business and the finance department in potentially unimagined ways.

Risk and its management have always been on the board’s agenda. But the nature of risk is changing. It doesn’t have to function purely as a shield for strategy. Increasingly, companies will need to use it to inform their strategy from the outset. This requires new attitudes, new knowledge and new behaviours. And that will require businesses preparing now for these changes.

Maybe it’s time to assess how ready your business is to begin these changes.

Asking a different question about risk

A recent ACCA report highlighted just how little is known about how boards are truly integrating risk discussions into strategic decision making. There are different approaches to risk management in practice each with their own respective strengths and weaknesses. But there is some way to go to integrating strategy and risk decisions effectively and many conversations on risk appear to focus on the downside rather than upside.

Perhaps we should ask a different question– how can boards better exploit the opportunity implicit in risk and uncertainty to drive better business outcomes?

Risk and risk management are not always viewed in a positive way. Risk may bring with it the potential for losses, but it also offers the potential for opportunity.

Without appropriate risk-taking, organisations cannot exploit the full range of strategic opportunities that are available to them, nor can they hope to protect themselves from less positive outcomes.

And yet the majority of businesses concern themselves with negative risk management: risk assessment, reporting and control to enhance a board’s governance and internal control activities, reducing the probability that an organisation may deviate from its stated objectives and so fail to meet the needs of its stakeholders.

But changing technology, such as the growth of cloud computing and social media, creates opportunities for returns as well as losses as do the major political and economic changes.

Two very different approaches

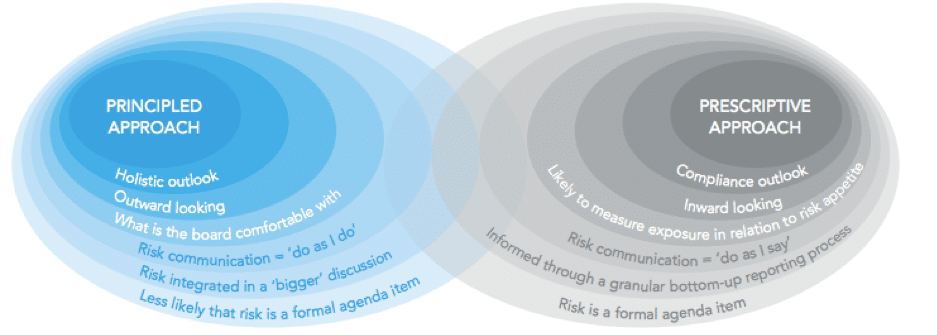

There are two broad approaches to risk:

- the Principled approach, where discussions about risk are more likely to focus on the exploitation of upside opportunities, and connect strategy and risk in an implicit and unstructured way, potentially leading to inconsistent risk management decisions

- and the Prescriptive approach, where risk-management activities are much more formalised and consistent, but with a high degree of focus on internal control which may mean that strategic opportunities are missed.

Two different approaches to risk. Which one are you?

Risk positive or risk averse?

In the face of increased complexity and uncertainty, the temptation for boards is to become more conservative and risk averse in an attempt to create certainty. In practice, businesses that choose to do this “risk” missing out on significant potential opportunities for their organisations and stakeholders. Worse still, they risk losing ground to entities with more innovative and entrepreneurial boards that are better able to steer their organisations towards the opportunities on offer.

0% Ready – Where to begin?

Unable to exploit strategic opportunities? Risk and risk management regularly features on the board agenda, irrespective of sector. It’s essential to place ‘risk’ in a positive context so your business can take the risks that lead to opportunities as well as mitigating the ones that bring losses.

Never more so than today, when changing business environments present uncertainty and literature and regulatory requirements abound.

Take action now by reading the ACCA report Risk and the strategic role of leadership.

25% Ready – made a good start?

You’ve made progress by conducting effective risk assessments and setting up the right reporting structures. These will enhance the governance capabilities of your board and help your organisation avoid deviating from its objectives.

Now you need to discuss and decide on how strategy and risk interact in your business. Is it strategy first, risk management second, or do you integrate risk at the outset to inform the choice of strategy?

Which model you choose will help define the future of your business.

50% Ready – halfway there?

You’ve decided to integrate your strategy and risk decisions. Now you need to look beyond the board, because how it embeds risk in its decision-making will echo out into the wider organisational body.

Are there lessons to be learnt from mishaps and failures? Use them as an opportunity to test the resilience of the risk framework and the appetite for risk of the company as a whole.

75% Ready – feeling confident?

You’ve not only successfully managed significant risk events, but you’ve used them as opportunities to further improve your processes. Remember to communicate your risk management strategy across the company, but also keep an ear to the ground.

Send your NEDs out into the business to socialise and build their qualitative understanding of the organisation’s cultural attitude toward risk.

100% Ready – so, what’s next?

Congratulations – you’ve built an integrated, dynamic risk management strategy. Its resilience is further enhanced by the fact that the board is open to constructive challenge, which prevents stagnation and complacency.

However, a changing environment means even the best risk management may not remain adequate for long. In the meantime, don’t forget to share your success by teaming up with ACCA to promote best-practice across your industry.

Ready for what’s next?

The ACCA has a strong track record in always looking ahead to anticipate change and understand its impact on business, finance and accountancy.

Now they are starting to work in partnership with employers around the world to help support them get ready for that change.

As part of this new initiative, they have looked at 10 major drivers of change, and are inviting employers to explore just how ready their businesses are to cope with them.

Find out more on the ACCA website and use the interactive tool to assess your business’ readiness to challenges such as:

- Blockchain and its impact on audit

- The great AI takeover

- The new skills gap

- The rising importance of ethics

- China’s Belt & Road initiative

- The impending talent crisis

- Coping with unmet training needs

- Trans-border business and a global economy

Is your business ready?

To find out more, and use the ACCA self-assessment tool, go to ACCA Global Readiness

Be the first to comment on "In the future, risk will be embraced as a positive – is your business ready?"